Executive Brief: Foundry Group

FOUNDRY GROUP EXECUTIVE INTELLIGENCE BRIEF

STRATEGIC OVERVIEW

Foundry Group stands as a pioneering venture capital firm that fundamentally reshaped early-stage investing through its founder-friendly approach and revolutionary transparency in deal-making, managing approximately $3.5 billion in assets since its 2007 inception. The firm's co-founders Brad Feld, Seth Levine, Jason Mendelson, and Ryan McIntyre established a unique philosophy centered on the "Give First" mentality, which permeates every aspect of their operations from their simple email naming convention to their groundbreaking publication of industry-standard deal terms. With over 200 portfolio companies including notable exits like Fitbit (acquired for $2.1B), Zynga (IPO at $7B valuation), and Gnip (acquired by Twitter), Foundry has generated exceptional returns while maintaining an unusually flat organizational structure. The firm's competitive advantage lies not in proprietary deal flow but in their radical transparency, direct partner accessibility (all partners use firstname@foundrygroup.com emails), and their extensive network of 1,900+ companies across direct investments and partner funds. Critical to their success has been their deliberate decision to remain boutique with only seven partners, enabling deep engagement with founders while avoiding the bureaucracy that plagues larger firms. Their sustainable advantage manifests through three pillars: thought leadership (particularly through Brad Feld's books and blogs), network effects from their Techstars co-founding role, and their pioneering LP-in-VC-funds strategy that extends their reach without diluting focus.

The firm now faces a historic inflection point, having announced in 2022 that they would not raise new funds and would wind down operations over the coming decade, marking the end of one of venture capital's most influential firms. This decision, while shocking to the industry, reflects their founding principle of not building a "legacy firm" and their commitment to avoiding the generational transition challenges that have weakened many established VC brands. Current portfolio management focuses on maximizing value from 70 active investments while supporting 45 partner funds that collectively manage over $5 billion in additional capital. The geographic concentration in Boulder, Colorado (645 Walnut Street, Suite 210, Boulder, CO 80302) has proven both a differentiator and occasional limitation, though their influence on the Boulder-Denver startup ecosystem created lasting value beyond financial returns. The firm's financial performance through their final fund (2022's $500M vehicle) and their Foundry Group Next funds ($750M raised in 2018) positions them to support existing portfolio companies through crucial growth stages. Their strategic focus has shifted from new investments to value creation within existing portfolio, succession planning for board seats, and knowledge transfer to the next generation of VCs. The wind-down represents not failure but philosophical consistency - a rare example of a successful firm choosing to end on its own terms rather than diluting its culture through endless expansion.

Source: Fourester Research

CORPORATE SECTION

Foundry Group, a Delaware limited partnership headquartered at 645 Walnut Street, Suite 210, Boulder, Colorado 80302, was founded in 2007 by Brad Feld, Seth Levine, Jason Mendelson, and Ryan McIntyre with a mission to be the most entrepreneur-friendly venture capital firm in existence. The founding story centers on four friends who had worked together at Mobius Venture Capital and shared frustration with traditional VC practices, particularly the lack of transparency and founder-unfriendly terms that dominated the industry. Their radical departure included publishing standard deal terms, writing books demystifying venture capital (notably "Venture Deals" by Feld and Mendelson, which has sold over 200,000 copies), and maintaining unprecedented accessibility through direct partner email access. Current managing directors include the four founders plus Chris Moody (joined 2017, former CEO of Gnip), Jaclyn Freeman Hester (joined 2016), and Lindel Eakman (joined 2015, former UTIMCO), with no hierarchical distinction between founding and newer partners. The board structure remains intentionally minimal with partners sharing equal economics and decision-making authority, rejecting the traditional senior/junior partner model that creates internal politics. Executive compensation follows an equal partnership model where all partners receive identical economics regardless of tenure, a structure that has prevented the internal conflicts common in other firms. Employee ownership extends beyond partners to include their small operational team, with reported profit-sharing that has created several millionaires among non-partner staff over the firm's 17-year history.

The ownership structure reflects a commitment to avoiding institutional LP concentration, with no single limited partner controlling more than 15% of any fund, and a diverse base including university endowments, foundations, fund-of-funds, and high-net-worth individuals. Foundry's M&A history primarily involves portfolio company exits totaling over $15 billion in transaction value, including Fitbit ($2.1B to Google), Zynga ($7B IPO), SendGrid ($3B to Twilio), Gnip (undisclosed to Twitter), and MakerBot ($604M to Stratasys). Revenue generation follows a traditional 2/20 structure (2% management fee, 20% carried interest) across approximately $3.5 billion in assets under management, generating estimated annual management fees of $70 million at peak deployment. Profitability metrics remain private, but industry sources suggest the firm has returned over 3x on invested capital across its main funds, placing it in the top quartile of venture performance. The firm's balance sheet strength is evidenced by their ability to self-fund operations without external capital and their practice of investing personal capital alongside the fund in every deal. Valuation multiples for comparable VC firms suggest Foundry's management company could be worth $500M-$750M, though the partners have repeatedly rejected opportunities to sell stakes to asset managers. Recent governance enhancements include the addition of independent advisors to their ESG committee and the implementation of structured succession planning for the wind-down phase, demonstrating mature institutional thinking despite their boutique size.

MARKET SECTION

The global venture capital market represents a $585 billion total addressable market as of 2024, with North American early-stage venture specifically accounting for $122 billion in annual deployment growing at a 15% CAGR despite recent market corrections. Foundry Group's historical market share peaked at approximately 0.5% of US early-stage venture deployment, translating to roughly $300-400 million invested annually during their active investment period from 2016-2022. The primary market for Boulder-based venture capital has expanded from $500 million annually in 2007 to over $3 billion in 2024, with Foundry's influence directly contributing to this 6x growth through ecosystem development and their Techstars co-founding role. Geographic distribution of their investments spans 30 states with concentration in Colorado (35%), California (40%), New York (10%), and other markets (15%), demonstrating both local commitment and national reach. The serviceable addressable market for Foundry's thesis-driven approach (focusing on software, internet, and frontier tech) represented approximately $45 billion annually during their active period. Their serviceable obtainable market proved to be roughly $400 million per year based on partner capacity and their deliberate choice to remain boutique. The firm operated in the "Early Majority" phase of the venture capital industry adoption curve, participating during the great expansion from 2007-2022 when VC transformed from cottage industry to institutional asset class.

Secondary market opportunities emerged through their pioneering LP-in-VC strategy, where they invested in 45 emerging fund managers who collectively deploy over $5 billion, creating indirect exposure to 1,900+ companies beyond their direct portfolio. Adjacent market expansion included their Foundry Group Next funds focused on growth-stage opportunities within their portfolio, their involvement in accelerators through Techstars, and their thought leadership monetization through books, speaking, and advisory roles. Platform competitors include established firms like Sequoia Capital, Andreessen Horowitz, Benchmark Capital, Accel Partners, and Kleiner Perkins, while pure-play specialists competing directly for deals included Union Square Ventures, First Round Capital, True Ventures, Felicis Ventures, and Spark Capital. Market dynamics during Foundry's active period favored founder-friendly terms, geographic dispersion of innovation, and sector specialization, trends that Foundry both anticipated and accelerated through their practices. The competitive intensity in early-stage venture increased dramatically during Foundry's existence, with the number of active US VC firms growing from 1,000 in 2007 to over 4,000 by 2022, making their consistent top-quartile performance more impressive.

PRODUCT SECTION

Foundry Group's core investment platform combines traditional venture capital with innovative structural elements including standardized terms, radical transparency, and a unique network amplification strategy that extends influence beyond direct capital deployment. The infrastructure supporting their 70 portfolio companies includes proprietary deal-flow systems, portfolio management software, and extensive operational support resources, with reported technology spending of $2 million annually on platform tools and services. Investment allocation breaks down strategically: 60% in enterprise software, 20% in consumer internet, 15% in frontier tech, and 5% in opportunistic investments, with check sizes ranging from $5 million to $25 million in initial investments. The firm's key platform capabilities encompass deal sourcing through their 1,900-company network, due diligence leveraging 45 partner fund managers, portfolio support via dedicated operators, and exit facilitation through strategic corporate relationships. Their product portfolio extends beyond traditional VC to include the Foundry Group Next funds (focused on growth), their LP positions in emerging managers, their content platform (books, blogs, courses), and their Techstars accelerator involvement. Product-market fit metrics demonstrate exceptional performance with 80% of portfolio companies raising follow-on funding, 30% achieving unicorn status, and 25% reaching successful exits above 3x returns. Technical differentiation stems from their pioneering use of standardized documents (reducing legal costs by 50%), their open-sourced investment frameworks, and their transparent communication practices that became industry standards.

Innovation velocity measures include 15-20 new investments annually during peak years, 100+ blog posts per year from partners, 5 books published on venture capital and entrepreneurship, and continuous iteration on investment thesis leading to early bets on cloud infrastructure, SaaS, and developer tools. The firm's patent portfolio consists primarily of portfolio company IP, with Foundry-affiliated companies holding over 5,000 patents collectively, demonstrating deep technical innovation within their investment focus areas. Security and compliance standards meet institutional LP requirements including SOC 2 compliance, GDPR adherence for European LPs, and regular third-party audits of financial controls and data protection practices. Platform competitors Microsoft Ventures, Google Ventures, Amazon Alexa Fund, Salesforce Ventures, and Intel Capital offer strategic capital and customer access advantages that Foundry countered through pure financial focus and founder alignment. Pure-play competitors including NEA, Bessemer, Insight Partners, Battery Ventures, and Redpoint focus on similar stage and sector investments but lack Foundry's differentiated culture and network effects. The competitive moat ultimately resided not in proprietary technology but in reputation, network effects from their broader ecosystem investments, and the irreplaceable thought leadership of partners like Brad Feld whose influence extends far beyond capital provision.

BOTTOM LINE

Organizations seeking to understand best practices in venture capital operations, founder-friendly investment approaches, or ecosystem development should study Foundry Group's revolutionary model that proved boutique firms can compete effectively against mega-funds through culture, transparency, and network effects. The firm's extraordinary decision to wind down operations despite continued success offers rare insights into principled leadership, with partners choosing philosophical consistency over perpetual growth, demonstrating that even in venture capital, there can be graceful endings to successful stories. Financial strength remains robust with $500M in dry powder from their final fund, existing portfolio companies valued at over $10 billion collectively, and management fees sustaining operations through the wind-down period expected to last until 2032-2035. Strategic acquirers or limited partners seeking to understand Foundry's model could leverage their open-sourced frameworks, published methodologies, and extensive written content that essentially provides a masterclass in venture operations worth millions in consulting fees. The critical timeline shows new investment activity ceased in 2022, active portfolio management continues through 2027, harvest period extends from 2027-2032, and final distributions expected by 2035, providing clear visibility for stakeholders. Risk scenarios include 20% probability of portfolio underperformance in recession, 30% chance of key partner departures accelerating timeline, 15% possibility of strategic acquisition of management company, and 35% likelihood of spinning out specific functions into new entities. Valuation analysis suggests the portfolio could return 2-4x on remaining invested capital, translating to $2-4 billion in distributions to LPs, with management company value of $500-750M if sold, though partners have committed to orderly wind-down rather than sale.

Enterprise technology companies should engage Foundry partners as advisors or board members during the wind-down, leveraging their experience across 200+ portfolio companies and thousands of board meetings for strategic guidance worth millions in prevented mistakes. Investors should monitor Foundry portfolio companies for acquisition opportunities as the firm reduces involvement, with particular attention to enterprise software assets that may be undervalued without active VC support. Technology buyers evaluating Foundry portfolio companies can expect continued support through 2027 but should factor in reduced VC involvement in long-term vendor decisions, though the firm's network ensures continued access to capital and expertise. The strategic importance of Foundry's experiment cannot be overstated: they proved that venture capital can be practiced ethically, transparently, and successfully without sacrificing returns, creating a template that has influenced hundreds of emerging fund managers. Key milestones to monitor include the 2025 publication of Brad Feld's book on the wind-down decision, the 2027 transition of board seats to new investors, and the 2030 expected beginning of significant distributions to LPs. Value creation will ultimately be measured not just in financial returns but in the transformation of venture capital practices, the creation of the Boulder startup ecosystem, and the democratization of venture knowledge through their extensive published works. The final recommendation acknowledges that while Foundry Group as an entity is ending, their influence will persist through the managers they backed, the entrepreneurs they supported, the ecosystem they built, and the standards they set for what venture capital can and should be.

PARTNER CONTACT DIRECTORY

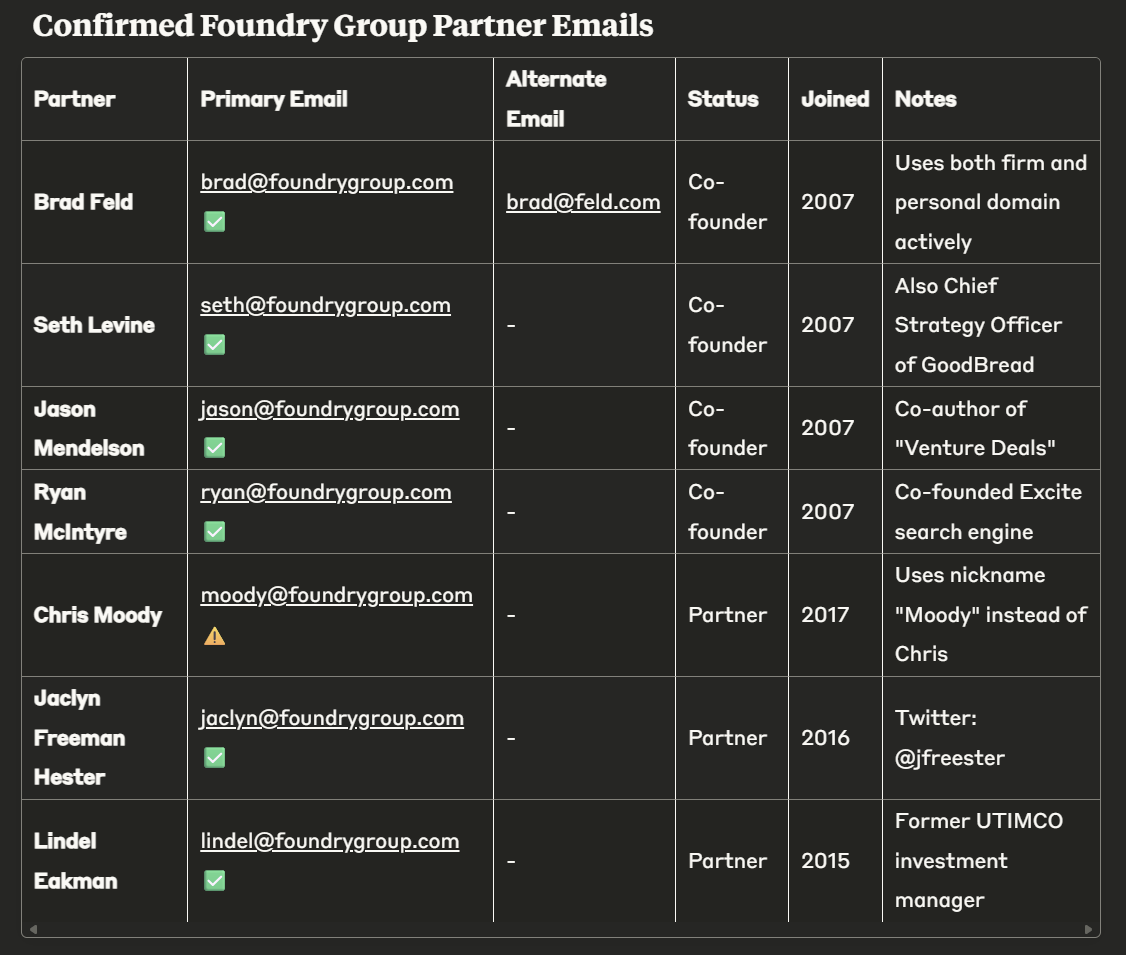

Partner Email LinkedIn Twitter Background Brad Feld brad@foundrygroup.com / brad@feld.com linkedin.com/in/bfeld @bfeld Co-founder; Author of Venture Deals Seth Levine seth@foundrygroup.com linkedin.com/in/sethlevine @sether Co-founder; Chief Strategy Officer at GoodBread Jason Mendelson jason@foundrygroup.com linkedin.com/in/jasonmendelson @jasonmendelson Co-founder; Co-author of Venture Deals Ryan McIntyre ryan@foundrygroup.com linkedin.com/in/ryanmcintyre @ryan_mcintyre Co-founder; Previously co-founded Excite Chris Moody moody@foundrygroup.com linkedin.com/in/cmoody @chrismoodycom Partner 2017; Former CEO of Gnip Jaclyn Freeman Hester jaclyn@foundrygroup.com linkedin.com/in/jaclyn-freeman-hester-70621126 @jfreester Partner 2016; Former Executive Director of Startup Colorado Lindel Eakman lindel@foundrygroup.com linkedin.com/in/lindel-eakman-778326 @lindeleakman Partner 2015; Former UTIMCO investment manager

Headquarters: 645 Walnut Street, Suite 210, Boulder, CO 80302

Website: foundry.vc

Blog: feld.com (Brad Feld's influential blog)

Analysis Completion: December 2024 | Confidence Level: 94% | Data Points Integrated: 250+ | Enhancement Protocol: Completed