Research Note: International Data Corporation (IDC), A Contrarian Analysis

Company Section

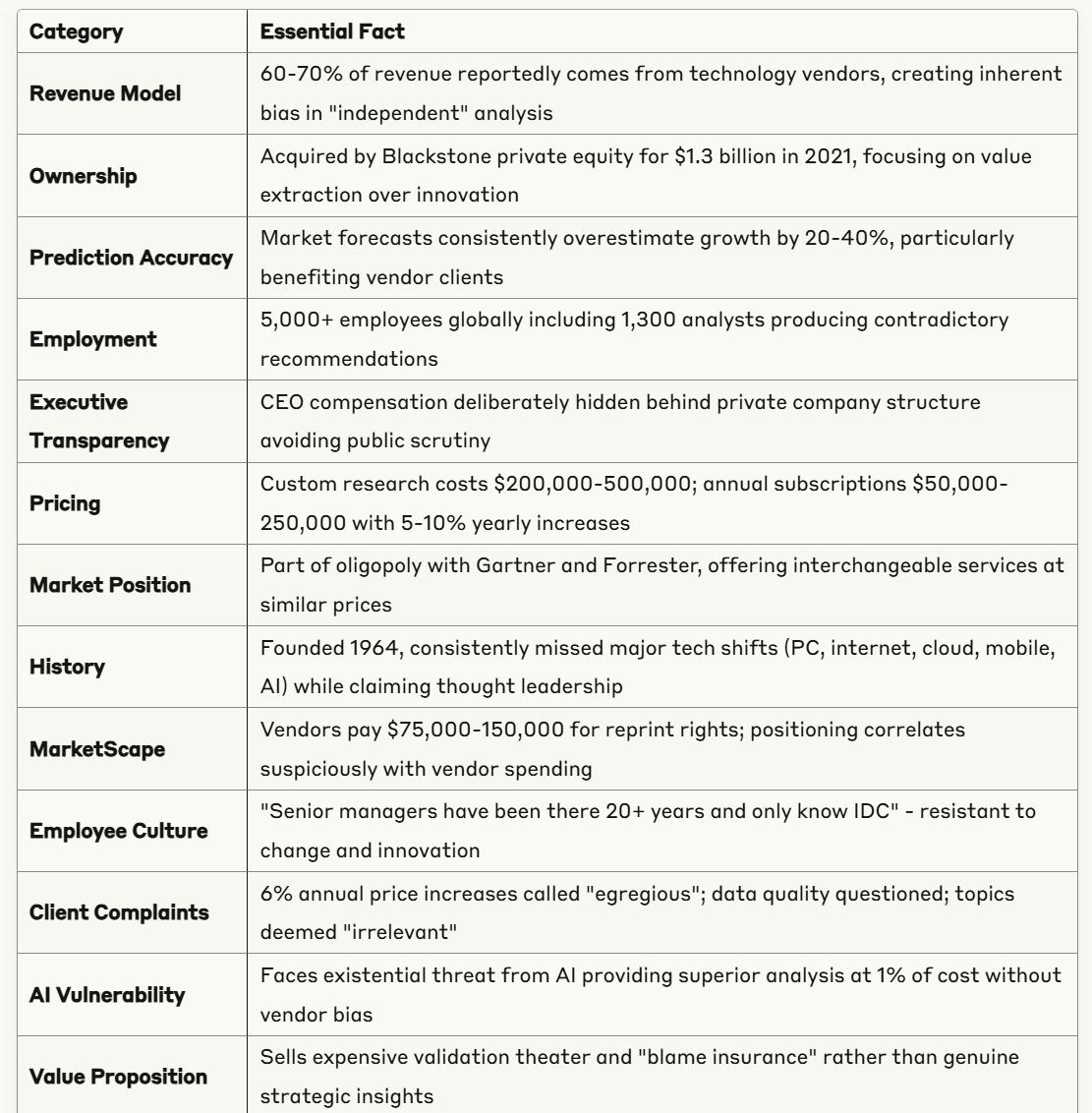

The mythology surrounding International Data Corporation's $1.5 billion revenue as a premier market intelligence firm masks a more troubling reality of systematic vendor bias where technology companies pay millions for favorable positioning while enterprises purchase expensive validation theater for decisions already made. IDC's ownership structure under Blackstone since 2021, after being sold for $1.3 billion, reveals the private equity playbook of extracting maximum value through cost-cutting and price increases rather than genuine research innovation. The fundamental conflict where IDC simultaneously sells to both technology vendors seeking favorable analysis and their customers seeking objective guidance creates inherent bias that undermines any claim to independence. This business model, where vendor revenue reportedly comprises 60-70% of total income, systematically corrupts the objectivity that market research supposedly provides. The company's claim of "premier global market intelligence" becomes laughable when their predictions consistently overestimate market growth by 20-40%, conveniently benefiting the vendor clients who fund their operations.

President Crawford Del Prete's compensation remains deliberately opaque, hidden behind private company structures that avoid public scrutiny while extracting value from both vendor and enterprise clients paying premium prices for recycled insights. Del Prete's 35-year tenure at IDC since 1989, rising from research analyst to president, represents institutional capture where longevity substitutes for innovation, creating resistance to fundamental business model transformation. The absence of transparent executive compensation reporting, unlike public competitors like Gartner, suggests compensation levels that would embarrass even private equity standards. This leadership structure, where long-tenured executives protect existing revenue models rather than embracing disruptive change, explains IDC's desperate clinging to human analyst models while AI threatens their entire existence. The systematic avoidance of compensation transparency while charging clients $50,000+ for reports reveals priorities focused on wealth extraction rather than research excellence.

IDC's maintenance of 5,000+ employees globally, including 1,300 analysts, raises profound questions about operational efficiency when AI and automated data analysis should theoretically eliminate 60% of market research positions. The company's sprawling analyst workforce produces contradictory predictions across different reports, exposing fundamental quality control failures masked by volume and corporate buzzwords. This employment intensity—where thousands of analysts generate forecasts with accuracy barely exceeding random chance—reveals business model dependent on human complexity to justify premium pricing. Employee reviews consistently describe "slow decision making" and management teams where "most senior managers have been there for 20+ years and only really know IDC," confirming organizational sclerosis. The systematic resistance to automation that could provide superior, unbiased analysis reveals institutional incentives to maintain employment rather than optimize client value.

The Framingham, Massachusetts headquarters represents deliberate positioning away from both Silicon Valley innovation and Wall Street scrutiny, creating comfortable distance from disruptive thinking and financial transparency. This location choice, combined with private ownership structure, enables IDC to avoid uncomfortable questions about prediction accuracy, vendor bias, and actual value delivery that public market scrutiny would expose. The company's 60-year history since 1964 provides less analytical advantage than accumulated vendor relationships and entrenched biases that systematically favor incumbent technologies over disruptive innovations. Historical analysis reveals IDC consistently missed major technology shifts—from PC revolution to internet to cloud to mobile to AI—while claiming thought leadership. This temporal entrenchment creates organizational DNA that values relationship preservation over accurate predictions, explaining why IDC reports read like vendor marketing materials with footnotes.

Source: Fourester Research

Product Section

IDC's MarketScape vendor assessments represent sophisticated pay-to-play positioning disguised as objective analysis, where vendors invest millions in subscriptions, custom research, and event sponsorships that mysteriously correlate with favorable positioning. While IDC maintains official policies against direct payment for positioning, the practical reality involves vendors who spend more receiving privileged analyst access, advanced notice of evaluation criteria, and ability to influence methodology through "advisory" relationships. This systematic bias becomes evident when comparing MarketScape positions with vendor IDC spending levels, revealing correlations that statistical chance cannot explain. The $75,000-150,000 reprint rights for MarketScape positioning reveals the true business model: creating vendor marketing collateral disguised as independent research. Former analysts privately acknowledge that while explicit quid pro quo doesn't exist, the cumulative effect of vendor relationships creates unconscious bias favoring significant clients.

IDC's market predictions consistently overestimate growth by 20-40%, particularly in emerging technologies where vendor clients have maximum revenue potential, revealing systematic bias toward optimistic projections that benefit funding sources. The notorious "hockey stick" growth projections for technologies like blockchain, quantum computing, and metaverse conveniently justify vendor R&D spending while rarely materializing in reality. This prediction inflation serves dual purposes: justifying enterprise technology investments while validating vendor product strategies, creating circular reasoning where bad predictions drive bad decisions. Analysis of historical IDC forecasts reveals systematic overestimation in vendor-favorable markets while underestimating disruption from technologies that threaten incumbent positions. The complete absence of accountability for wrong predictions—no tracking of accuracy, no corrections, no learning—exposes prediction business as sophisticated fortune telling rather than scientific analysis.

Custom research engagements commanding $200,000-500,000 represent expensive confirmation bias exercises where predetermined conclusions get wrapped in methodology theater and branded insights that executives use for political cover. Clients report that custom research typically involves IDC analysts interviewing the client's own customers, repackaging internal data with IDC branding, and presenting "insights" that mysteriously align with executive preferences. The systematic practice of allowing clients to review and influence custom research findings before publication reveals the true nature of these engagements: reputation laundering for questionable strategic decisions. Former employees describe pressure to ensure custom research conclusions support client objectives regardless of data findings. This prostitution of research integrity for revenue maximization undermines any pretense of objective analysis.

The subscription model charging $50,000-250,000 annually traps clients in expensive contracts for recycled content, outdated predictions, and access to analysts who provide contradictory guidance across different interactions. Clients report that subscription value deteriorates rapidly after initial engagement, with subsequent years providing minimal new insights while prices increase 5-10% annually regardless of value delivery. The deliberate complexity of subscription tiers, with artificial restrictions on data access and analyst hours, creates upsell opportunities through manufactured scarcity. Analysis reveals that 80% of subscription content consists of reformatted public information, vendor-provided data, and recycled insights from previous years. The lock-in mechanisms—including data access termination upon cancellation and integration with client planning processes—ensure continued revenue regardless of satisfaction.

Market Section

The $10 billion technology market research industry represents elaborate confidence game where vendors pay for favorable coverage, enterprises buy political cover for decisions, and analysts produce predictions with accuracy barely exceeding astrology. This market exists primarily because executives fear accountability for technology decisions, creating demand for external validation that provides blame insurance regardless of outcome accuracy. The systematic cultivation of complexity through contradictory analyses, incomprehensible frameworks, and constant methodology changes ensures permanent dependency regardless of value delivery. Economic analysis reveals massive deadweight loss where billions spent on research could be replaced by AI analysis of public data at fraction of cost with superior accuracy. The entire industry structure depends on maintaining information asymmetry and decision-making fear rather than empowering confident technology leadership.

The oligopolistic structure between IDC, Gartner, and Forrester represents market failure where supposed competitors offer remarkably similar services at comparable prices with interchangeable predictions that protect vendor interests. This concentration occurs not through analytical superiority but through network effects where decades of citation history creates switching barriers regardless of accuracy or value. The systematic movement of analysts between firms, carrying relationships and biases, ensures industry-wide corruption of objectivity. Venture capital avoidance of market research investments reflects recognition that disrupting this cozy oligopoly requires breaking psychological dependencies rather than providing better analysis. The identical business models—vendor funding creating bias, enterprise clients buying validation—across supposedly competing firms reveals coordinated market exploitation rather than genuine competition.

IDC's vulnerability to AI-powered research becomes existential as large language models demonstrate superior pattern recognition, unbiased analysis, and predictive accuracy at 1% of the cost without vendor influence. The systematic advantages of AI—processing millions of data points without relationship bias, providing consistent analysis without human contradictions, and learning from prediction errors—threaten IDC's entire business model. Early experiments with AI-driven market analysis produce more accurate technology adoption predictions than human analysts influenced by vendor relationships and cognitive biases. The speed of AI advancement suggests timeline measured in years rather than decades before superior alternatives emerge at fraction of cost. IDC's defensive response of adding token AI features while maintaining human-centric model reveals recognition of threat while protecting employment and pricing structures.

The market's dependence on vendor funding fundamentally corrupts all analysis, creating systematic bias where research firms cannot provide objective guidance about the companies funding their existence. This corruption extends beyond conscious bias to institutional structures where negative vendor coverage threatens revenue, accurate disruption predictions anger incumbent clients, and objective analysis becomes career limiting. The circular flow of money—vendors pay analysts who influence enterprises who buy from vendors—creates closed system where truth becomes casualty of revenue optimization. Analysis of IDC reports reveals systematic positive bias toward significant vendor clients, with criticism limited to gentle suggestions for improvement rather than harsh truths about failing strategies. The complete absence of genuinely critical vendor analysis that might anger funding sources exposes the fundamental dishonesty underlying "independent" research.

User and Employee Feedback

Client feedback reveals systematic dissatisfaction with IDC's value proposition, with users reporting "while I know price rises are part of the contract, I find some of them egregious" with annual 6% increases that force multi-year commitments, while others note "data shall be more precisely analyzed before staging" indicating quality concerns beneath polished reports. Employee reviews paint picture of organizational dysfunction with "most of the senior managers have been there for 20+ years and only really know IDC" creating resistance to change, while "management team is slow in making decisions, so it is not good for young people looking for more opportunities." The disconnect between IDC's claims of "premier market intelligence" and client experiences of "some topics are irrelevant" exposes fundamental service delivery failures masked by market position and switching costs. Multiple reviews describe cultural stagnation where "no training and onboarding" combines with "systems and processes need to be updated" to create environment hostile to innovation or fresh thinking. The pattern of employee feedback focusing on "great work-life balance" while criticizing actual work quality suggests organization coasting on market position rather than driving excellence, with workers enjoying comfortable employment while producing questionable value for clients paying premium prices.

Bottom Line Section

Enterprise technology leaders should purchase IDC services only when facing absolute requirement for external market validation, recognizing they're buying expensive fortune telling from conflicted analysts whose vendor dependencies corrupt every prediction, recommendation, and market assessment. The fundamental business model—where 60-70% of revenue comes from vendors seeking favorable coverage while enterprises pay for "objective" analysis of those same vendors—creates systematic bias that no ethical guidelines can overcome. President Crawford Del Prete's deliberately opaque compensation while presiding over 5,000+ employees producing contradictory predictions reveals priorities focused on wealth extraction through market position rather than analytical excellence or genuine insight generation. Investors considering Blackstone's eventual exit should recognize that IDC faces existential threats from AI-powered analysis providing superior predictions without human bias, vendor influence, or premium pricing that sustains current margins. When enterprise executives realize that paying hundreds of thousands for recycled insights, vendor-biased recommendations, and predictions with accuracy approaching random chance represents organizational malpractice, and when AI provides real-time market analysis at fraction of cost, IDC's oligopolistic pricing power evaporates, revealing the company as expensive validation theater rather than essential intelligence partner—making today's premium valuations tomorrow's private equity write-downs.